Hong Kong, 04-2025. Bloomberg article written by Bei Hu.

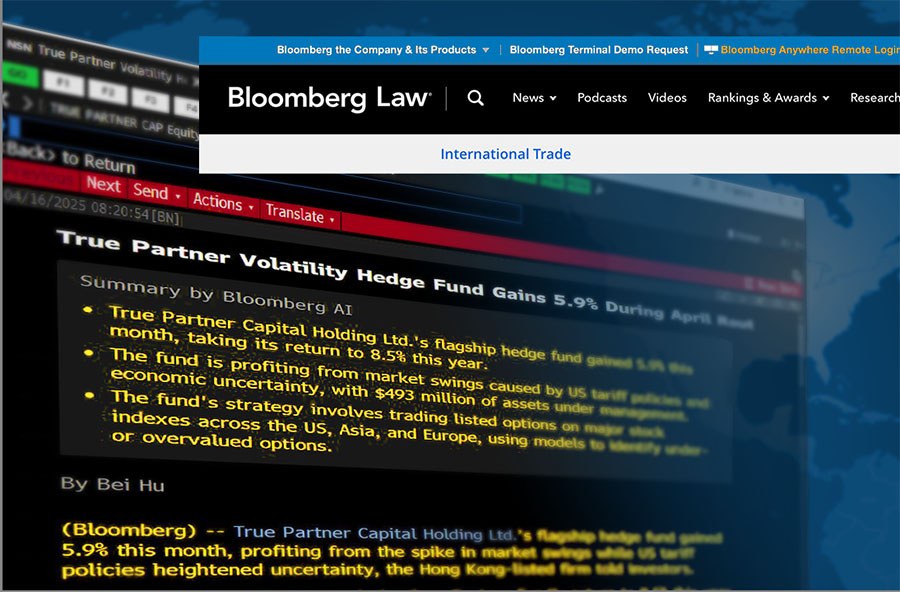

True Partner Capital Holding Ltd.’s flagship hedge fund gained 5.9% this month, profiting from the spike in market swings while US tariff policies heightened uncertainty, the Hong Kong-listed firm told investors.

The gain through April 11 took the True Partner Fund’s return to 8.5% this year, according to a newsletter sent to investors. The fund is set for its strongest first four months of the year since 2020.

US President Donald Trump’s whipsawing policies have sent markets into a volatile spin. With $493 million of assets under management, True Partner is trying to capture returns brought on by the economic uncertainty and fear gripping global markets.

Trump announced so-called reciprocal tariffs on exporters to the US early this month, stoking concerns of a global recession. He announced a 90-day pause on some of the duties hours after they went into effect, amid signs of panic in the US Treasury market. The VIX Index, commonly known as the market’s fear gauge, shot to a five-year high before dropping on April 9.

“Volatilities have already notably retreated from their early April highs,” True Partner wrote in the newsletter. “But policy uncertainty remains high.”

The US-China trade tit-for-tat only intensified, even after Trump’s temporary halt on tariffs. The market gyrations wrong- footed many hedge funds, from trend followers to stock pickers. The True Partner Fund trades mostly listed options on major stock indexes across the US, Asia and Europe, using models to help identify those that are under- or overvalued.

True Partner was founded in 2010 by former employees of market-maker Saen Options BV. The firm now has offices in Europe, the US and Asia. Its shares have traded on the Hong Kong stock exchange since October 2020.

–––––––––––––––––––––––––––––––

Written by:

Bei Hu in Hong Kong at bhu5@bloomberg.net

View this story in Bloomberg:

news.bloomberglaw.com

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- True Partner article: Does America First signal the end of American exceptionalism?

- True Partner’s co-CIO speaking at the Global Volatility Summit Tokyo

- True Partner Capital speaks in Northern Trust panel about Navigating the Shift to WTP

- Happy New Year

- True Partner article: 2025 Market Outlook

- One VIX spike does not make a summer

- More news articles >

- Go to events >