Page 2: Volatility update March 2019

In order to judge how much momentum the volatility short trade has left in the short term, we should revert back to 2017. For most of the year, dismal levels of realized volatility invited yet more volatility sellers in a reinforcing feedback loop that seemed to go on perpetually until it didn’t. While it only cracked up in February 2018, the first signs of frailty were already visible at the end of 2017. Table 3 below shows that in October 2017 implieds were still comfortably above actual movement, fueling the feedback loop. But come December month end, that was mostly gone.

Table 3: 2017 Realized and Implied Volatility

In our view the current volatility landscape is more in line with the very end of 2017. From a behavioral perspective this makes sense as well. By backtracking on rate hikes and balance sheet reduction, the Fed yet again reinforced the Powell Put; previously also known as Yellen Put, Bernanke Put and Greenspan Put…. Hence, there was a rush to cash in on this renewed market backstop by selling volatility and buying equity. As the process is perceived to be a repetition of the past, logically the speed of the process increases which explains the breakneck pace of volatility declines this time around. This increased speed can be seen as a “learning curve”, although the “knowledge” learned can be disputed.

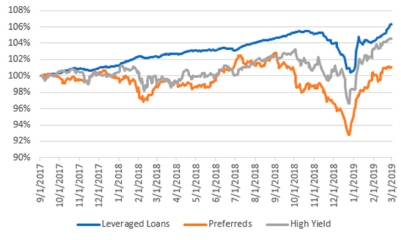

Interestingly, in addition to the compression of volatility, other typical higher risk carry trades have roared back to life from their December swoon. For example High Yield (as reflected by the HYG ETF), Preferred Shares (as reflected by the PFF ETF) and Leveraged Loans (as reflected by the S&P LSTA US Leveraged Loans Index) are all trading at or very near their highs. A veritable dash-for-trash seems to be on after Powell’s flexibility comments, with risk assets getting priced near perfection.

Chart 1: Recent Performance of Selected Carry Trades

Amongst all the frothiness observed in the markets, for the near future, there is still a difference between concluding it is December 2017 again and predicting whether and when February 2018 will happen again. While all it takes is a catalyst with which a quick unravelling of the Goldilocks Markets could take place, markets have shown to be quite adept at ignoring all kinds of negative news and threats for a prolonged period. Until then, it pays for a volatility trader to remain patient and diligent, knowing that all parties come to an end.

–––––––––––––––––––––––––––––––

About the authors

Mr. Govert Heijboer, Co-CIO of True Partner, has been active as a market maker trading in the European and Asian derivatives markets as well as positional trading since 2003. Govert started as a trader/researcher at Saen Options in Amsterdam and rose to become the director of derivatives trading and a member of the executive team in 2007. In 2008 he moved to Hong Kong to set up and assume responsibility for all trading activities in the new Saen Options Hong Kong branch office. Govert holds a PhD in Management Science and an MSc in Applied Physics from the University of Twente, Netherlands. He is a founding partner and has worked on the launch of the True Partner Fund since March 2010.

Mr. Tobias Hekster, Co-CIO of True Partner, has been actively trading for the past 21 years in various different roles in several markets across the globe. Starting at IMC in 1998 as a pit trader in Amsterdam, Tobias has established the off-floor arbitrage desk, headed the Chicago office in the transition from floor trading to electronic trading and set up the Asian volatility arbitrage desk in Hong Kong. Tobias holds an MSc in Economics and he teaches as an Adjunct Associate Professor at the Chinese University of Hong Kong and as an Adjunct Professor of Financial Practice at National Taiwan University.

–––––––––––––––––––––––––––––––

The full publication of this article is available as a PDF. Download it following the link below:

March 2019 Volatility - Party like it's 2017>>

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- True Partner article: Does America First signal the end of American exceptionalism?

- True Partner’s co-CIO speaking at the Global Volatility Summit Tokyo

- True Partner Capital speaks in Northern Trust panel about Navigating the Shift to WTP

- Happy New Year

- True Partner article: 2025 Market Outlook

- One VIX spike does not make a summer

- More news articles >

- Go to events >