Page 2: Volatility update January 2021

Echoes of 1999?

Perhaps inevitably given the size of stimulus in 2020, some excess liquidity seems to have found its way into risk asset prices – indeed this is one of the intentions of QE, through “wealth effects” and the “portfolio rebalancing” channel. However, there are signs of over-exuberance, with recent months having seen turbo-charged gains in some areas. It is hard to explain the fundamentals behind the ~300% rise in Bitcoin since September (an additional $500 billion in market cap and a 4x rise vs gold) and the doubling of Tesla since mid-November (an additional $400 billion in market cap). MicroStrategy issuing convertible bonds at a sub-1% yield to make a leveraged Bitcoin investment is another harbinger of the times.4 The over 240 SPAC IPOs in 2020 offer a pointed reminder of the pre-2008 vintage of SPACs which, euphemistically speaking, did not end well. At the same time, FOMO (Fear Of Missing Out) is undoubtedly pressuring sceptics to get on board the “this time it’s different” bandwagon.

As others have noted, it is hard not to be reminded of the exuberance of 1999 and early 2000.5 As then, we are seeing high retail participation and new technologies making it easier and cheaper for small investors to trade. That era is often remembered as one in which companies with no realistic business model were overvalued by retail hype. Clearly, there were some IPOs with shall we say “optimistic” business models (readers may remember Pets.com, which went bust within 12 months of its successful IPO…) But a large part of the boom was over-excitement about fundamentally good companies that were just bid up way too high. To give an example, in late 1999/early 2000, Cisco doubled in value, adding $300bn in market cap in four months as markets anticipated future brilliance. Since then Cisco has had a 4-fold increase in revenues and a 5-fold increase in profits (more than 2x faster growth than US GDP for 20 years) – a huge fundamental success. But markets had priced in even more. Cisco stock fell 90% from its peak and its share price has still not recovered its March 2000 levels.

At the same time as this exuberance, occasional headlines remind that not everything is going up. Signs of distress are rising in commercial real estate6, while it was recently noted that some luxury apartments and retail properties in Manhattan have been valued at only half their value just a few years ago.7 After the 2008 crisis and the sharp market recovery of 2009, European periphery debt problems became a major focus in 2010. Will some of the underlying issues remaining from the Covid-crisis escalate over the next 1-2 years?

But will risk assets broadly reverse soon? From a cyclical perspective, once vaccines are rolled out, economic activity will surely increase, and jobs in affected sectors will start to come back. With savings high amongst the better-off, as and when economies reopen, there would seem to be ample room for higher consumer spending, which some analysts expect to drive a rise in meaningful rise in inflation. Central banks may ignore that and keep short-term rates low, allowing yield curves to steepen, and we have already seen a rise in breakeven inflation rates. Higher growth usually is good for markets and so many strategists are advocating holding on. With many equity markets higher than pre-Covid-19 levels, a large part of the recovery must be priced in – but how much?

The pace of reopening could yet disappoint. Social distancing and other protective measures may also need to remain for some time, limiting capacity levels. Thus far, vaccine roll outs are also taking longer than hoped as the logistical challenge of rapidly producing and delivering millions upon millions of doses proves as difficult as one might think. For all the economic benefits of the policy support in 2020, much has been based on loans, not grants. For many companies, Covid-19 has simply meant productive assets lying idle, saved from bankruptcy by increased borrowing. Repaying borrowing will be a drag on future earnings and some companies may learn the hard way there is a difference between liquidity and solvency.

Worryingly, Covid-19 itself seems to be trying to outpace the amazing speed of human ingenuity in virus fighting. Recent mutations have resulted in much more infectious strains that are pushing healthcare systems in some countries to their limits. While the UK has so far been the worst hit by this, it is of note that the UK is also one of very few countries that routinely screens test results to identify such mutations. If mutations occur elsewhere, they may not be identified so quickly. More infectious strains require a faster response to be contained. Indeed, Brisbane recently announced a lockdown on the back of a single case of this new variant. The need to react in such ways means the cost of containment could remain high. Net, there are various ways the pace of the return to normal could be disappointing slow.

Diversification is harder to find

Ultimately, with cash yields generally zero or negative, investors have to buy something. As another acronym claims, “There Is No Alternative” (to equities). Returning to the asset allocation dilemma, ultra-low government bond yields mean lower expected portfolio returns for many and a less well hedged portfolio. That means there is pressure to take more risk elsewhere, at the same time as there is less room to do so.

Equities and Bonds during the Equity Drawdown

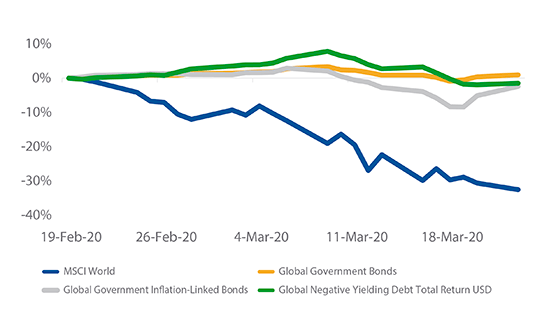

One popular answer to this seems to be to reduce government bonds, hold on to risk assets, take more liquidity risk, and look for diversification elsewhere. While there are arguments both ways, it’s easy to see the case for reducing government bonds. Many such bonds offer negative yields and did little in Q1. Indeed, being long Japanese, German or Swiss bonds – places where rates were already negative entering the sell-off– lost money in March. Negative carry and no diversification is a difficult mix.

Even long-term US Treasuries, which had strong returns in Q1 overall, were a somewhat unreliable hedge in the heat of the equity sell-off, impacted by heavy positioning which caused significant volatility. Taking the TLT ETF (which holds 20y+ Treasuries) as a proxy, long-term US Treasuries were down slightly from 19th Feb (the peak of the S&P 500) through 18th March – a period over which the S&P 500 was down 29% and the Fed had already cut rates dramatically. That’s not usually the kind of behavior one expects from a hedging asset.

Will Treasury yields go lower in a big risk off move? Probably. But it will be hard to repeat the returns of Q1. The Fed has been pretty clear it doesn’t like the idea of negative rates and a flat yield curve causes problems for the banking system, which profits from borrowing short and lending long. Policymakers seem likely to try to find different tools. Researchers at the BIS recently noted that the diversification benefits of Treasuries had already been declining for some time. It’s also worth recalling, as the BIS highlighted, that the negative equity/bond correlation markets have become used to is not a fixed phenomenon: looking over the long-term, equities and bonds have had long periods of positive correlations in the past.8

Moves in recent months also highlight the risk of capital loss in bonds. Following Biden’s election win and the narrowly Democratic Senate, the US 10-year yield has decisively cleared the 1% mark. With the Fed committed to making up for past under-inflation to achieve its “average” target level, that means targeting above 2% inflation for some period. So we could see heavy borrowing, a dovish Fed and rising inflation all at the same time. Already in 2020 some in Europe were arguing for central banks to simply write off government bonds, effectively directly printing to finance spending. Net, there are various reasons a negative real yield doesn’t seem particularly attractive.

Inflation-linked bonds are not a panacea either as inflation expectations tend to drop during major risk off moves. Looking from the peak to the trough of the S&P 500 drawdown in Q1, US inflation linked government bonds had a marginally negative total return. The global equivalent index was down -2.4%, or -6.5% without a USD hedge. Inflation linked bonds were also losers during the worst parts of the 2008 crash.9

Continue reading to the next page of this article >>

–––––––––––––––––––––––––––––––

The full publication of this article is available as a PDF. Download it following the link below:

January 2021 Volatility Update >>

–––––––––––––––––––––––––––––––

1. Throughout this document, MSCI World refers to the MSCI World Total Return Hedged to US Dollars (source: Bloomberg).

2. “A World at Risk: annual report on global preparedness for health emergencies”, World Health Organisation Global Preparedness Monitoring Board, September 2019 apps.who.int. The report warns of the theoretical risks of “high-impact respiratory pathogens… spread by respiratory droplets… [and which can] move rapidly across multiple geographies”

3. See gmo.com

4. See microstrategy.com

5. Indeed, we note that one well respected asset manager has recently launched a product based on the prediction of a TMT unwind similar to that seen from 2000-02

6. “Distress looms over U.S. commercial real estate in 2021”, Marketwatch, 13 December 2020; marketwatch.com;

7. “Billionaires’ Row Condo Records 51% Resale Loss in Luxury Glut”, Bloomberg, January 8, 2021 bloomberg.com;

“Ho, ho — oh, no! Values of troubled Manhattan retail properties sink 53%”, Marketwatch, December 8, 2020; marketwatch.com

8. Avalos, Fernando and Xia, Dora, “US Treasuries and equity sell-offs: is the hedge faltering?”, BIS Quarterly Review, 7 December 2020

9. Indices used are the Bloomberg Barclays US Government Inflation-Linked All Maturities Total Return Index and the Bloomberg Barclays Global Inflation Linked Index Hedged USD and its unhedged equivalent. Source: Bloomberg

10. US Vol = VIX Index; Europe Vol = VStoxx Index; Japan Vol = Nikkei Stock Average

Volatility Index; Korea Vol = Kospi 200 Volatility Index (source: Bloomberg)

11. Sources: Bloomberg, True Partner. Data from Jan 2006 or earliest available through 12 Jan 2021.

12. “Are we on the verge of another financial crisis?” Harvard Business Review, 18 December 2020 hbr.org

- AI Top or Slop: When Markets Reach Peak Magnificence

- The Hedge Fund Journal features True Partner's award-winning volatility strategies

- True Partner Fund wins award for strong performance

- True Partner releases new thought piece focused on Dutch pension funds

- True Partner Fund nominated for best performing relative value fund

- Bloomberg article highlights True Partner’s strong performance in April and year-to-date

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- More news articles >

- Go to events >