In a recent speech, Dutch King Willem Alexander raised an important point as to the unprecedented times we find ourselves in. Let’s not normalize what’s not normal. In our view, this could also apply to how we look at the current markets.

Last Thursday’s (June 11th) downward move marked the first significant decline since the troughs of March, which despite being fairly recent, seem all but forgotten judging by the recent performance of stock markets around the world. As if the largest job-loss since the Great Depression of 1929 is normal. Or the increase of US debt by over one trillion dollars within five weeks. It took the US from Independence through 1981 to accumulate its first trillion of debt.

Wondering whether this is normal begs the question as to whether a market decline would constitute just one more of these buy-the-dip moments, or something more structural. From our perspective as volatility traders, while our strategy is quantitatively focused, the market backdrop is relevant in our daily trading. Therefore, we’d like to share our thoughts on markets and volatility looking forward, to frame what is or isn’t normal.

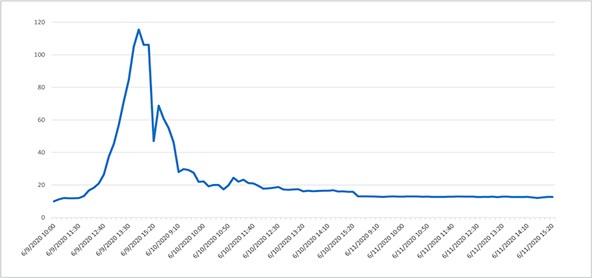

At first glance, the theme of a ‘healthy correction’ makes sense, given the well documented excesses of early June. A range of data suggests links to an “army” of daytraders that came into being from a combination of being stuck at home because of the COVID-19 lockdown in the US, additional stimulus checks during the same period, and nowadays being able to trade on zero-transaction cost platforms such as Robin Hood or Charles Schwab. For example, while the Chinese real estate developer FANGDD might have been a great prospect by itself, in all likelihood it was confusion with the FANG basket that has been the standard bearer of the tech rally which caused the share price to catapult from USD 10 to USD 120 (and back to USD 10) in a matter of days, creating and then removing billions of dollars of market cap in the process.

Similarly, price explosions in companies which had already filed for Chapter 11 bankruptcy protection caused some sniffles with self-proclaimed seasoned investors. The headline on the Hertz issuance of shares during bankruptcy proceedings captures the mood: “Hertz wins approval to offer potentially worthless stock.” This would not be the first time that the allure of quick riches has captured many, including the brightest minds, as Isaac Newton’s ill-fated investment in the South Sea Company in the 18th century, the hottest stock at that time, made clear. Newton famously said he “could calculate the motions of the heavenly bodies, but not the madness of the people.”

But any Schadenfreude of the implosion of the names on the Robintrack.net stock leader board might obscure a more general point: What if the recent excesses are merely the most eye-popping symptoms of a far more general complacency? Where maybe the phoenix-like rise of American Airlines or LiveNation stock have sprung out of a much more broadly held belief that, as Dave Portnoy, one of the prominent Robin Hood daytraders, aptly put it, “Stocks can only go up!” Is that materially different from the presumably more studied acronym TINA (There Is No Alternative)? FOMO (Fear of Missing Out) similarly haunts newly minted daytraders and established professional investors alike.

In a zero interest-rate world, with central banks ever more explicitly stepping in to accommodate the markets, stocks do smell like a one-way bet. And last Wednesday Fed Chairman Jerome Powell emphasized the Fed would not hold back even if it would be of the opinion asset prices are too high. Are they? Calling market frothiness or even a market bubble is far less difficult than timing the unwinding of it, as many smart investors found in 1999. But the volatility of recent days is a reminder that Powell has also said that monetary policy can restore liquidity, but not solvency. Perhaps the aftermath of the dot com boom is also worth bearing in mind.

Continue reading to the next page of this article >>

–––––––––––––––––––––––––––––––

The full publication of this article is available as a PDF. Download it following the link below:

True Partner Capital - article June 2020>>

–––––––––––––––––––––––––––––––

1. Elle Koeze. “The $600 Unemployment Booster Shot, State by State”. The New York Times, April 23rd 2020

–––––––––––––––––––––––––––––––

- AI Top or Slop: When Markets Reach Peak Magnificence

- The Hedge Fund Journal features True Partner's award-winning volatility strategies

- True Partner Fund wins award for strong performance

- True Partner releases new thought piece focused on Dutch pension funds

- True Partner Fund nominated for best performing relative value fund

- Bloomberg article highlights True Partner’s strong performance in April and year-to-date

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- More news articles >

- Go to events >