Page 3: Volatility update January 2020

Volatility spread opportunities were limited

As our regular readers and investors know, periods of market uncertainty and unease typically create the best alpha opportunities for our strategy, as volatility spreads shift quickly due to varying changes in sentiment, flows and realized volatility. That enables us to deploy our 24-hour, global trading capability and technology edge to quickly identify and capitalize on dislocations. Perhaps unsurprisingly given the strong market returns, but to our disappointment, 2019 gave few opportunities for strong alpha.

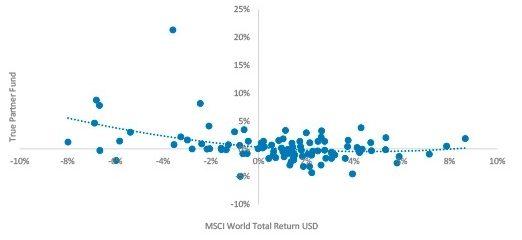

On the chart below, we show the monthly returns of the True Partner Fund on the vertical Y axis, and the monthly returns of the MSCI World Total Return USD on the horizontal X axis. The Fund has shown a negative correlation to the MSCI when the index is down, and almost no relationship when the index is up. We cannot promise to be up in every sell off, but we know that for many of our investors this is an important point of differentiation relative to most other assets and hedge funds.

This relationship has resulted in the Fund having a negative beta to the MSCI of approximately -0.4 since inception in July 2011. From a beta-adjusted perspective, 2019 looks less bad for us, but we were disappointed to fall some way short of our historical annualized alpha of +9% per year, resulting in a negative year for investors. In the second chart below we show the same data but highlight the 2019 data points. We can see that the returns were well within the range of historical experience, but there was lower alpha than the historical average.

True Partner Fund vs. MSCI World Total Return USD – Monthly Returns 8

True Partner Fund vs. MSCI World Total Return USD – Monthly Returns, 2019 Highlighted 9

Why was spread trading more challenging?

We never like being down but were feeling ok at the end of Q1 2019, having retained most of our Q4 2018 profits in the risk on rally of Q1 2019. After gaining +5.9% when the MSCI World fell -12.9% in Q4 2018, the Fund gave back a little less than half this return (-2.3%) in Q1, while the MSCI World almost fully reversed its gain, being up +12.9% in Q1 2019. However, performance in Q2 and Q3 was disappointing. While the MSCI World was up in both quarters (and +5.7% over the whole period), there were short lived bouts of market unease in May and August that threw up only limited opportunities.

In May, the MSCI World fell -5.6%, while in August a month-end rally kept the decline to only -1.9%. True Partner continued to provide diversification in these months, generating positive returns while equities and broad hedge fund indices were down. However, spread behavior was relatively subdued, limiting alpha opportunities, and we were surprised by the under-reaction of Asian volatility in August to what was quite a large market sell-off (Hang Seng down -7.4% for the month, with a peak to trough drawdown of -9% early in the month, and larger if one includes the end of July sell-off). This resulted in smaller profits than we had hoped for in August.

While we trade individual RV relationships, rather than at the regional level, and reposition daily, not monthly, the charts below help illustrate this. In each chart we show the difference between 1-month realized and 1-month implied volatility on the Y axis (so a positive number means that realized volatility came in higher than the market was expecting) and the market return on the X axis. To construct these series, first we construct regional data for the US, Europe and Asia by taking a simple average of the markets we trade in each region. We then average the US and European series to compare Asian vs. non-Asian volatility.

The first chart shows that non-Asian volatility had similar reactions to big up and down months for the underlying equity markets in 2018 and 2019, as shown in the first chart below, with a negative relationship between the volatility ‘surprise’ and the market return.

US and European Realized vs. Implied Volatility, 2018 and 2019 10

The chart below shows the Asian volatility ‘surprise’ vs. the performance of the underlying Asian indices. In 2018, Asian volatility reacted similarly to non-Asian volatility, with even higher rises in realized volatility (relative to implied) on downside moves – a help to long option positions. However, in 2019, realized volatility had a subdued reaction (relative to implied) making it a relatively unrewarding long position in what was a large sell-off for the market. While Hong Kong has often hit the headlines due to political tensions and protests in 2019, from a market perspective it has been remarkably calm on a relative basis.

Asian Realized vs. Implied Volatility, 2018 and 2019 11

-

Continue reading to the next page of this article >>

–––––––––––––––––––––––––––––––

The full publication of this article is available as a PDF. Download it following the link below:

January 2020 Volatility Update - Global cooling>>

–––––––––––––––––––––––––––––––

1. nytimes.com

2. Sources: Bloomberg, True Partner, Eurekahedge. True Partner Fund returns are Class B, USD, net of 2/20 fees.

3. cnbc.com

4. Sources: Federal Reserve, True Partner federalreserve.gov, federalreserve.gov

5. Sources: Bloomberg, True Partner. Kospi 200 value is the simple average of the last two trading days of December and the first trading day of January as liquidity is more limited beyond 6-month maturities.

6 -12. Sources: Bloomberg, True Partner

13. wsj.com

14. For those intrigued, the consensus forecast for 2008 S&P 500 returns was for an +11.1% gain – this miss accounts for a significant part of the on average over-optimistic bias.

15. nytimes.com

16. wsj.com

17. libertystreeteconomics.newyorkfed.org; on liquidity see libertystreeteconomics.newyorkfed.org and bankunderground.co.uk

18. US PredictIt 2020 Senate Party Control Democratic, as of January 10, 2020

19. bbc.com

20. Data from policyuncertainty.com based on the paper: Caldara, Dario and Matteo Iacoviello, “Measuring Geopolitical Risk,” working paper, Board of Governors of the Federal Reserve Board, 2017”.

21. Source: policyuncertainty.com

22. Source: Bloomberg Negative Yielding Debt Index Market Value, as of January 10, 2020

23. Source: Bloomberg, as of January 10, 2020

24. Source: Bloomberg Negative Yielding Debt Total Return Index

–––––––––––––––––––––––––––––––

- AI Top or Slop: When Markets Reach Peak Magnificence

- The Hedge Fund Journal features True Partner's award-winning volatility strategies

- True Partner Fund wins award for strong performance

- True Partner releases new thought piece focused on Dutch pension funds

- True Partner Fund nominated for best performing relative value fund

- Bloomberg article highlights True Partner’s strong performance in April and year-to-date

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- More news articles >

- Go to events >