Page 1: Opportunities Ahead in Chinese Markets

The asset management industry in China is growing at a rapid pace. With capital markets expanding in multiple avenues, China is becoming increasingly important to global investors. Specific areas of development include derivatives, which we believe have the potential to deliver new opportunities.

True Partner Capital actively monitors developments on the world’s major financial markets. Given the interconnectedness of global capital markets and supply chains, this includes not only those markets we currently trade, but also those that can influence our traded markets, or which may be suitable for inclusion in our opportunity set in future. At the moment, one of the markets in this group has been seeing significant developments: China. China is by any measure one of the world’s most important economies, with major influences on global markets. Having had an office in Hong Kong for over 10 years, but also an international presence in the US and Europe, we have long followed developments in China. Through our strategic relationship with Holland & Muh, we also have a presence in onshore China, which we expect to bring additional opportunities over time.

China’s financial markets, which include some of the largest and most liquid in the world, offer potentially strong sources of diversification and are also becoming more accessible. As derivative markets develop, a growing suite of more sophisticated strategies will be applied to them. There are also vast pools of retail and institutional capital seeking more advanced investment management solutions, and asset managers can now apply their investment processes and business models to Chinese markets, via majority or wholly owned local management companies.

Equity markets

Chinese public equity markets, worth over $10 trillion (or closer to $20 trillion including Hong Kong and US-listed ADRs), now rank second only to the US market capitalisation at around $50 trillion. They are global leaders for liquidity: the turnover ratio of around 300% for Shanghai and Shenzhen shares is between two and six times higher than for US or European equities, and in effect makes them the world’s most liquid equity market.1 However, surveys suggest most foreign investors have small positions or no position at all,2 though inflows have recently been increasing.3

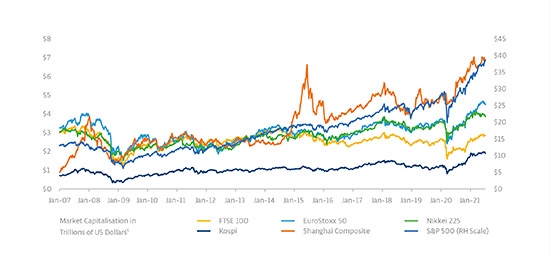

Chinese equity markets are also growing fast due to a buoyant IPO (and secondary offering) calendar. The tally of public companies has more than doubled over the past decade to around 4,000 listed on China’s Shanghai and Shenzhen exchanges, and there are another 8,000 OTC listed companies. In contrast, while the market capitalisation of US public equity markets has grown substantially over time, the breadth has narrowed, as the number of public companies in the US has roughly halved from approximately 8,000 in the mid-1990s to a little over 4,000 today. Greater China leads the world in IPOs4: in 2020, China’s Shanghai and Shenzhen exchanges recorded 383 new listings, while Hong Kong saw 140, according to KPMG. On the mainland bourses, replacing the old approval system with a new registration-based regime has streamlined the process. Overall, the IPO pipeline has contributed to the significant growth of market capitalization over the past years, as is reflected in the graph below.

Chinese equities have a bigger market cap than many other globally significant equity indices

Equity derivatives are developing both inside and outside China. Onshore equity index futures were historically restricted to hedging but can now be used for directional trading. Furthermore, regulators want to encourage more institutional participation in futures markets, CSRC Chair Fang Xinghai told the FIA in December 2020.

However, listed futures and options are currently limited to indices and ETFs, but that could change: Hong Kong’s Financial Services Development Council has proposed augmenting the Stock Connect schemes with more derivatives and structured products linked to mainland equities.6

Some brokers also offer shorting via swaps. And overseas exchanges are listing Chinese equity index futures: for instance, Eurex in June 2021 launched futures on the MSCI China Tech 100 Index, as well as futures and options on the MSCI Hong Kong Listed Large Cap and the MSCI China Hong Kong Listed Large Cap indexes.

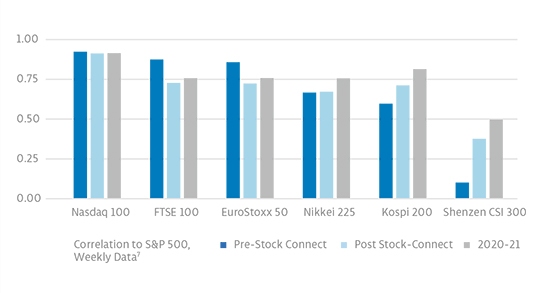

Not only are the Chinese equity markets interesting given their sheer size, they also tend to behave somewhat differently from most of their global peers. The chart below shows that while the correlation between Chinese markets and the S&P 500 has increased following the Stock Connect, the correlation remains significantly lower than the correlation of other global markets with the S&P 500. From this perspective, China still offers the potential for significant diversification benefits.

Chinese equity markets have had a low but evolving correlation to other key equity markets

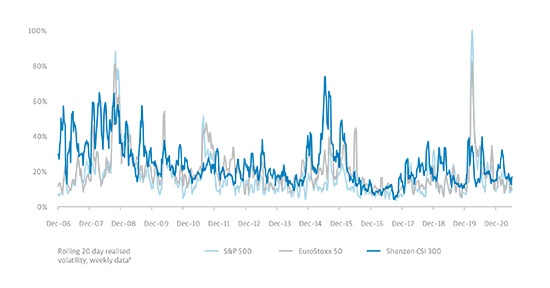

And interestingly, Chinese markets not only provide diversification in terms of correlation. The magnitudes of market movement, as reflected in realized volatilities also differs from other key global markets. The chart below highlights the volatility differences, with both periods in which Chinese markets moved disproportionally (such as late 2015), or in which these markets were somewhat shielded from global movement (such as in early 2020).

Chinese equity volatility has a dynamic relationship with US and European markets

Continue reading to the next page of this article >>

–––––––––––––––––––––––––––––––

The publication of this article is available as a PDF. Download it following the link below:

Opportunities Ahead in Chinese Markets>>

–––––––––––––––––––––––––––––––

1. 10 things to know about China equities, Allianz Global Investors, accessed June 2020www.allianzgi.com

2. “The merits of a standalone equity allocation to China”, Willis Towers Watson, November 2020

3. “International investors flock to Chinese assets”, Financial Times, 15 July 2021. One factor affecting the share of assets in Chinese markets may be restrictions on foreign access to Chinese domestic markets. These have historically been significant but many barriers to such access have been reduced or removed in recent years.

4. China to dominate world IPO league in 2020, Nikkei Asia, December 18, 2020asia.nikkei.com

5. Sources: Bloomberg, True Partner. Data from Jan 2007 to July 2021

6. Expanding Access to the A Share Market, Hong Kong Financial Services Development Council, September 2020 www.fsdc.org.hk

7. Sources: Bloomberg, True Partner. Data from Jan 2007 to July 2021.

8. Sources: Bloomberg, True Partner. Data from Dec 2006 to July 2021

9. China opens futures markets further to outside world, Futures Industry Association, November 25, 2020 www.fia.org

10. China launches aluminum, zin options to serve real economy, XinhuaNet, August 10, 2020www.xinhuanet.com

11. The internationalization of the China corporate bond market, ICMA, January 2021; Bond Market Size, ICMA, August 2020 www.icmagroup.org; www.icmagroup.org

12. The internationalization of the China corporate bond market, ICMA, January 2021 www.icmagroup.org

13. BNY Mellon opens 4 trillion repo niche to holders of China debt, Bloomberg, April 13, 2021 www.bloomberg.com

14. Data from Oliver Wyman cited in “Foreign asset managers are eyeing China’s vast pool of savings”, The Economist, June 12, 2021www.economist.com

15. China market liberalisation for global asset managers, HSBC, July 16, 2020www.gbm.hsbc.com

- AI Top or Slop: When Markets Reach Peak Magnificence

- The Hedge Fund Journal features True Partner's award-winning volatility strategies

- True Partner Fund wins award for strong performance

- True Partner releases new thought piece focused on Dutch pension funds

- True Partner Fund nominated for best performing relative value fund

- Bloomberg article highlights True Partner’s strong performance in April and year-to-date

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- More news articles >

- Go to events >