Broken records and records broken

Chicago/Hong Kong, August 2017 - Mr. Govert Heijboer and Mr. Tobias Hekster, both co-CIO of True Partner Capital give their vision on the extreme low volatility in the first 7 months of 2017.

Volatility wise 2017 so far is like a broken record. Volatilities keep going down, then ominous news appears creating a brief spike after which volatility goes down again… and again… and again.

Needless to say this ongoing repetitive behavior has led the VIX to break new records, with all-time-low numbers and recently the narrowest 10-day high-low range for the S&P500 index in our lifetimes. Extrapolating in a linear way, like we humans tend to do, would assume this will continue in the foreseeable future. However, time and again history has shown that markets are cyclical, which has always caught the majority of investors off-guard.

Sub-zero volatility?

During the Great Financial Crisis, lowering interest rates by Central Banks was one of the methods to contain the damage. In its aftermath, monetary policy became extremely accommodative but few could foresee the degree to which global interest rates became negative. One of the side effects of the sea of global liquidity has been a massive reduction in market volatility. This begs the question, as one well regarded investor posted, whether current extremely low volatility can turn negative. Spoiler alert: NO! Where fees for depositing money are feasible, negative movement does not exist. Volatility is often seen as the fear in the market, but that is not entirely true. It is more the temperature of the market. Markets can get overheated when they fall “ill” with fear sending them sharply down. However, markets can also get overheated by getting overexcited, creating a bubble-like atmosphere leading to rising volatility like in the Tech bubble. Temperature has an absolute zero point at which all movement of atoms would stop and so has volatility, going below is impossible.

Vaporized volatility

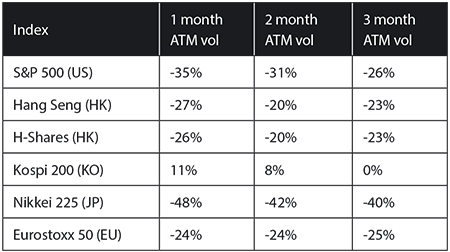

That said, global volatilities do appear to be on a collision course with absolute zero. Since 2012 global volatilities have declined, but this year appears to be particularly brutal. A look at the year-to-date changes in at-the-money volatility is telling.

With the exception of Korea, global implied volatility levels have declined by 25% or more, from already depressed levels at the end of 2016. Coupled with US equity markets at all time highs, and other global markets having racked up significant increases as well, we would have two crucial observations on volatility

(i) Market highs combined with extremely low volatility levels could provide for cheap insurance of investment portfolios

(ii) Periods of low volatility could persist for some time, even when storms are brewing

Nobody wants insurance? Buy it cheap and manage it

We would like to paraphrase Warren Buffet’s view on the insurance business. One should be selling insurance when others do not and thus premiums are high and one should abstain from selling insurance when risk-seekers have driven premiums down. In the option space, one would express the premium for protection as a percentage of the underlying index. At the nadir of the Great Financial Crisis, one would pay about 8% of the S&P500 index value for 1-month protection (buying an at-the-money put option). Nowadays, similar protection would cost less than 0.8%. Lower option prices on longer dated expiries provide opportunities for valid hedges of equity portfolios. But timeframe remains crucial. This is where the second observation comes in.

The team at True Partner has experience in options markets dating back to the late 1990’s and we have seen periods of depressed volatility before. Undeniably, these times are difficult for volatility traders, but eventually these lulls have also been shown to be part of a cycle and eventually give way to a cornucopia of trading opportunities. Until that moment, preservation and mitigating the time decay of protection through volatility is the key. This is where the current market environment is different from some we have observed in the past: the ‘term structure’ is flatter.

The term structure is the relationship between the expected movement in shorter dated and longer dated options. Usually in periods of quiet, the market discounts the chance for movement on short timeframes, but is far more uncertain over longer timeframes. This is translated in a big difference in volatility between short dated options (low) and longer dated options (much higher). This makes owning volatility more challenging: one could buy cheap short dated options, but these will decay quick if movement remains elusive. Or one could pay up significantly for longer dated options.

Ominous as the observation might be, this time it actually is different. A global army of ‘risk premia capturers’ selling volatility have not only driven the shorter end of the term structure to extremely low levels, but have subsequently taken the longer end down as well. Occasionally and in selected markets, this allows for a favorable way to own volatility. Spreading between longer dated and shorter dated options, to achieve a favorable position: retain exposure to increases in volatility, while minimizing time decay. But please note this is easier said then done and optimizing requires continuous monitoring and management of position.

And as with all insurance, the penalty for being late is significantly larger than being early. Thus one ought to wonder where exactly we are. While the markets appear immune for any geopolitical stress and dismissive of the dysfunction in Washington, there are also some structural changes in markets that will result in instability down the road. We would like to high light 3. The dominance of ETF’s, ‘Volatility Controlled Investing’ and perceived safety from flawed risk analysis.

Will ETF investors orderly exit in case of a shock?

The explosion of ETF’s is not only changing liquidity patterns across markets but is also lowering the threshold for active investing. A significant part of ETF inflows stem from less experienced investors. Where literally hundreds of millions of new investment dollars are easily digested daily in a rising market, it remains to be seen if that remains the case if investors start to head for the exits. Just as in real-life, if something frightening is happening everybody will head for the exit at the same time. As we have seen in the June 2013 taper tantrum, ETF flows can exacerbate sell-offs. In this case, the MSCI Emerging Market ETF (EEM) was more liquid then its underlying instruments and US hour movement in this ETF drove subsequent sell-offs in the Asian timezone. One can only wonder if a stampede would occur in mega ETF’s such as SPY.

Who will control volatility in case of a shock?

Volatility Controlled Funds are an example of financial markets rebranding existing ideas. The concept is intuitively simple: when movement is low, one could increase risk and leverage but when movement increases risk and leverage ought to be reduced. This works in theory, but in practice market movement and volatility are correlated: downward movements tend to be more violent. Therefore, these funds will have to unwind into market downmoves adding proverbial fuel to the fire. This concept rings familiar for those who remember the popular Portfolio Insurance of the late 1980’s (October 1987 to be precise).

2008 is VaR, VaR away

Financial markets derive certainty from avoiding to repeat past accidents. The concept of Value at Risk is backward looking, usually 3 or 5 years.

Therefore, many risk (and return) analyses assume a continuation of the extremely loose monetary policy we have witnessed over the past 5 years. And the subsequent demise of market volatility that came with it. For a whole generation of traders and risk managers, this is the only reality they have seen.

2008 and the volatilities that came with it are seen as an aberration and of course this new, smarter, generation is confident that they will not let it happen to go that far again.

The wheels are in motion

Any external trigger might kickstart instability in the near future as after a while, a broken record will annoy anyone into action. With cumulatively over 50 years of options trading experience in our True Partner team, evolved from pit trading to High Frequency Trading, we are ready for the inevitable instability that will come once the cycle turns.

–––––––––––––––––––––––––––––––

About the authors

Mr. Govert Heijboer, Co-CIO of True Partner, has been active as a market maker trading in the European and Asian derivatives markets as well as positional trading since 2003. Govert started as a trader/researcher at Saen Options in Amsterdam and rose to become the director of derivatives trading and a member of the executive team in 2007. In 2008 he moved to Hong Kong to set up and assume responsibility for all trading activities in the new Saen Options Hong Kong branch office. Govert holds a PhD in Management Science and an MSc in Applied Physics from the University of Twente, Netherlands. He is a founding partner and has worked on the launch of the True Partner Fund since March 2010.

Mr. Tobias Hekster, Co-CIO of True Partner, has been actively trading for the past 18 years in various different roles in several markets across the globe. Starting at IMC in 1998 as a pit trader in Amsterdam, Tobias has established the off-floor arbitrage desk, headed the Chicago office in the transition from floor trading to electronic trading and set up the Asian volatility arbitrage desk in Hong Kong. Tobias holds an MSc in Economics and he teaches as an Adjunct Associate Professor at the Chinese University of Hong Kong and as an Adjunct Professor of Financial Practice at National Taiwan University.

–––––––––––––––––––––––––––––––

The publication of this article is available as a PDF. Download it by following the link below:

True Partner Capital - Bottoms up for volatility>>

Copyright© True Partner Capital, True Partner Advisor 2017. All rights reserved.

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- True Partner article: Does America First signal the end of American exceptionalism?

- True Partner’s co-CIO speaking at the Global Volatility Summit Tokyo

- True Partner Capital speaks in Northern Trust panel about Navigating the Shift to WTP

- Happy New Year

- True Partner article: 2025 Market Outlook

- One VIX spike does not make a summer

- More news articles >

- Go to events >