Being long Asia versus short U.S. as in 2008 turned out to work otherwise.

In a publication by Bloomberg the platform writes about high volatility in March and asked Govert Heijboer, Co-CIO of True Partner Capital about this situation.

–––––––––––––––––––––––––––––––

Shortened version of Bloomberg article:

The sudden breakdown of a decades-long relationship between U.S. and Asian stocks has blindsided hedge funds, turning what were meant to be low-risk bets on volatility into big money losers.

Managers suffered losses in March on wagers that equity-market swings in Asia would be more extreme than those in the U.S. or Europe, according to people with knowledge of the matter. The bets were widespread among traders who focus on volatility, said Govert Heijboer, co-chief investment officer of Hong Kong-based True Partner Capital, a $1.4 billion hedge fund firm whose flagship volatility product gained 10% in March.

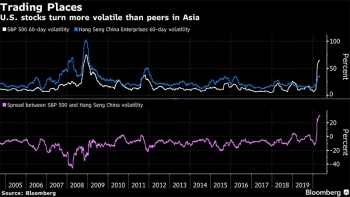

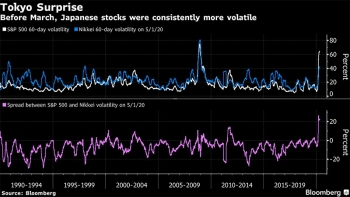

While the trades performed well in back tests over three decades, and produced big returns during the 2008 financial crisis, they fell apart in March as the coronavirus pandemic roiled global stocks. Swings in the S&P 500 Index soared far above those of benchmark gauges in Asia - hitting a record versus Chinese shares in Hong Kong and touching the highest levels relative to Japanese and South Korean equities since Wall Street’s Black Monday crash in 1987.

The dramatic reversal highlights the risk of relying on historical market relationships to guide investments, an approach that has come under renewed scrutiny this year as many quantitative funds underperformed their benchmarks. Opinions differ on why the link between U.S. and Asian volatility broke down, but some investors have pointed to the growing complexity of U.S. market structure and the stabilizing presence of government funds and central banks in Asia. America has also become the new epicenter of the pandemic, with confirmed cases skyrocketing in March even as infection rates across much of Asia leveled off.

“Being long Asia versus short U.S. volatility worked in 2008, so it back tested well as a trade for stressed environments” Heijboer said. “In practice, it turned out otherwise.”

Hedge fund wagers on price swings have swelled in recent years in part due to a steady supply of volatility exposures generated by the structured products desks of big investment banks. In a process sometimes called “risk recycling,” many banks have been offloading these exposures to their trading clients to comply with stricter post-2008 financial regulations.

One of the instruments favored by hedge funds - the corridor variance swap - allows for bets on relative volatility but can lead to outsized losses when markets move in the wrong direction.

China’s central bank has kept the financial system flush with liquidity this year, while the so-called National Team of state-backed funds has helped underpin confidence in stocks after stepping in to support prices in the wake of a market crash in 2015. The sanguine mood has also buoyed Hong Kong shares, which attracted a record HK$137.9 billion ($18 billion) of net inflows in March via exchange links with the mainland.

Meanwhile in Japan, the central bank has been pouring money into Tokyo-listed exchange-traded funds as part of its unorthodox monetary stimulus program -- often buying on days when the stock market declines. The Bank of Japan owned an estimated 31 trillion yen ($290 billion) of ETFs at the end of March, according to NLI Research.

When shocks like the pandemic force leveraged U.S. investors to unwind their bets on low volatility, the argument goes, bouts of market turbulence are amplified. Some analysts blamed the phenomenon for sharp swings in U.S. stocks in late 2018, one of the rare periods before this year when the S&P 500 became more volatile than Asian counterparts like the Hang Seng China Enterprises Index. Up until March, 60-day swings in the U.S. gauge had been smaller than the Chinese index more than 90% of the time since Bloomberg began compiling the data in 1993.

What happens next is far from clear. While it’s possible that March was just a blip and that the historical U.S.-Asia volatility relationship will reassert itself, True Partner’s Heijboer isn’t willing to bet on it.

“It is difficult to predict,” he said, citing uncertainties around structured product sales, the economy and the varying impact of the virus. “There are many moving parts.”

–––––––––––––––––––––––––––––––

The full publication is available on Bloomberg:

www.bloomberg.com

Authors: Bei Hu, Viren Vaghela, and Nishant Kumar

With assistance by Donal Griffin, and Min Jeong Lee

May 7th, 2020

©2020 Bloomberg L.P.

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- What would a significant market downturn mean for Dutch pension funds?

- True Partner article: Does America First signal the end of American exceptionalism?

- True Partner’s co-CIO speaking at the Global Volatility Summit Tokyo

- True Partner Capital speaks in Northern Trust panel about Navigating the Shift to WTP

- Happy New Year

- True Partner article: 2025 Market Outlook

- One VIX spike does not make a summer

- More news articles >

- Go to events >